Pin

Pin Photo courtesy of Multiprenur

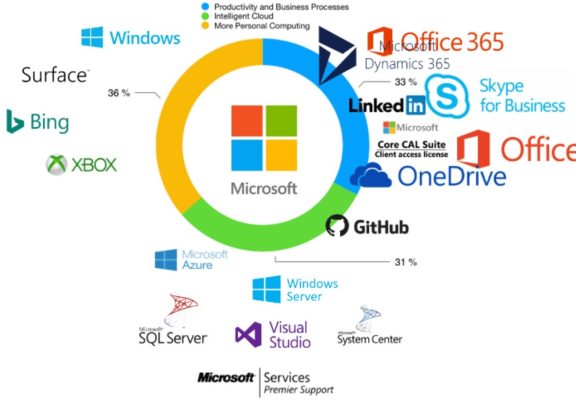

Synopsis: Since 2014, Microsoft has invested over $140 billion acquiring companies like LinkedIn, GitHub, Activision Blizzard, and Nuance Communications. This massive spending wasn’t about collecting companies like trophies. Each purchase served a specific purpose in transforming Microsoft from a Windows-dependent company into a diversified technology powerhouse. The acquisitions targeted cloud computing, artificial intelligence, professional networking, and gaming—sectors that define the future of technology. Understanding this strategy reveals how tech giants position themselves for long-term dominance in an increasingly competitive digital landscape.

The year 2014 marked a turning point for one of technology’s most iconic companies. Microsoft faced a sobering reality: the world was moving beyond desktop computers, and the company’s core business model was becoming obsolete. Revenue from Windows licenses was declining as people shifted to smartphones and tablets. The cloud computing revolution was accelerating, and competitors were gaining ground.

Microsoft spent $140 billion on tech acquisitions as part of a complete reinvention strategy. This wasn’t panic buying or desperate moves to stay relevant. Each acquisition was carefully chosen to fill critical gaps in capability, market presence, or technological expertise. Building these capabilities from scratch would have taken a decade or more, time the company simply didn’t have.

The transformation required thinking differently about what Microsoft actually was. No longer just a software company selling products, it needed to become a comprehensive technology platform provider. Acquisitions offered the fastest path to this new identity, bringing not just technology but entire ecosystems of users, developers, and business relationships that would take years to cultivate organically.

Table of Contents

LinkedIn Changed the Professional World Forever

Pin

Pin Photo courtesy of Multiprenur

The $26.2 billion LinkedIn acquisition in 2016 raised eyebrows across the business world. Critics questioned why Microsoft would spend so much on a social networking site when Facebook and Twitter dominated that space. But this thinking missed the entire point of the purchase.

LinkedIn wasn’t just another social network. It was a professional data goldmine containing information about 500 million workers, their skills, career histories, and business connections. This data could power everything from AI-driven job matching to personalized learning recommendations. More importantly, LinkedIn gave Microsoft direct access to the professional world in ways that Windows or Office never could.

The acquisition proved brilliantly strategic. LinkedIn’s revenue has more than doubled since the purchase, growing from $3 billion annually to over $15 billion. The platform integrated seamlessly with Microsoft’s other products, allowing Office 365 users to see LinkedIn profiles directly within Outlook and Teams. This created a unified professional ecosystem that competitors couldn’t match, making both products more valuable together than they ever were separately.

GitHub Brought Developers Into the Fold

Pin

Pin Photo courtesy of Multiprenur

Developers are the kingmakers of modern technology. They decide which platforms succeed, which tools become industry standards, and which companies earn their loyalty. Microsoft understood this when it purchased GitHub for $7.5 billion in 2018, despite initial resistance from the developer community.

GitHub hosted over 100 million code repositories and served as the central hub where developers worldwide collaborated on projects. Owning this platform gave Microsoft unprecedented influence over how software gets built. The company could integrate its developer tools directly into the workflows that programmers used daily, making Microsoft technologies the path of least resistance.

The acquisition also repaired Microsoft’s relationship with the open-source community, which had historically viewed the company with suspicion. By keeping GitHub independent and even making it more accessible, Microsoft demonstrated commitment to supporting developers regardless of which technologies they chose. This goodwill translated into broader adoption of Azure cloud services and Visual Studio tools, creating a virtuous cycle that continues generating revenue today.

Gaming Became a Multibillion-Dollar Bet

Pin

Pin Photo courtesy of Multiprenur

The gaming industry generates more revenue than movies and music combined, yet Microsoft’s Xbox division struggled to compete with Sony’s PlayStation. Rather than concede defeat, the company doubled down with acquisitions that fundamentally changed its gaming strategy. The purchases of Mojang (Minecraft) for $2.5 billion, ZeniMax Media for $7.5 billion, and Activision Blizzard for $68.7 billion weren’t just about owning popular games.

These acquisitions supported a radical shift toward gaming as a service rather than hardware sales. Microsoft’s Game Pass subscription offers unlimited access to hundreds of titles for a monthly fee, similar to how Netflix transformed video entertainment. Owning the studios that create blockbuster franchises like Call of Duty, Overwatch, and Elder Scrolls meant Microsoft could offer exclusive content that justified the subscription cost.

The strategy extends beyond traditional gaming consoles. Cloud gaming allows people to play high-quality games on phones, tablets, and low-end computers by streaming from Microsoft’s data centers. Owning premier content makes this service compelling, while the subscription model creates predictable recurring revenue. This transforms gaming from a hit-driven, cyclical business into a stable growth engine that generates billions annually regardless of console sales cycles.

The Cloud Computing Arms Race

Cloud computing represents the biggest shift in technology infrastructure since the internet itself. Companies no longer need to maintain their own server rooms and data centers. Instead, they rent computing power from providers like Amazon Web Services, Microsoft Azure, and Google Cloud. This market will reach $1 trillion annually, making it the most important battleground in technology.

Microsoft’s acquisitions targeted specific cloud computing capabilities that Azure needed to compete. The company purchased numerous smaller firms specializing in cybersecurity, data analytics, and infrastructure management. Each acquisition added features that made Azure more competitive against AWS, which held an early lead in cloud services.

The cloud strategy also influenced larger acquisitions. LinkedIn’s data feeds AI models running on Azure. GitHub’s code repositories help train development tools powered by Azure’s computing infrastructure. Gaming services stream through Azure data centers. By creating interconnected services that all rely on cloud infrastructure, Microsoft ensured that success in any one area drives demand for Azure services, creating a business model where different divisions reinforce each other’s growth.

Artificial Intelligence Needed Real-World Applications

Pin

Pin Photo courtesy of Multiprenur

AI research produces impressive demonstrations, but turning that research into useful products requires vast amounts of real-world data and practical applications. Microsoft’s acquisition strategy focused heavily on companies that could provide both. The $19.7 billion purchase of Nuance Communications particularly exemplified this approach.

Nuance specialized in healthcare AI, with speech recognition systems used by doctors and hospitals worldwide. This gave Microsoft access to medical data and workflows, allowing the company to develop AI tools specifically for healthcare providers. Doctors could dictate patient notes naturally while AI systems automatically generated proper medical documentation, saving hours of administrative work.

The strategy recognized that generic AI capabilities matter less than AI solving specific problems for specific industries. By acquiring companies already embedded in healthcare, customer service, and other sectors, Microsoft could deploy AI where it generated immediate value. These real-world applications created feedback loops that improved the underlying AI models, making Microsoft’s technology more capable than competitors building AI in isolation from practical use cases.

The Subscription Economy Required New Business Models

Pin

Pin Photo courtesy of Multiprenur

Traditional software sales followed a simple pattern: customers paid once for a product, used it for years, then eventually bought an upgrade. This model generated lumpy, unpredictable revenue. Subscription services completely change this dynamic, creating steady monthly income that’s far more valuable to investors and easier to manage operationally.

Microsoft’s acquisitions accelerated the transition to subscriptions. LinkedIn Premium, Game Pass, GitHub Pro, and Office 365 all charge recurring fees rather than one-time purchases. This shift transformed Microsoft’s financial profile, making revenue predictable and increasing the company’s market value. Wall Street rewards predictable recurring revenue far more generously than unpredictable product sales.

The subscription approach also changes customer relationships fundamentally. Instead of selling a product and moving on, subscription services require continuously delivering value or customers cancel. This forces companies to keep improving their offerings, adding features, and responding to user needs. Microsoft’s acquisitions brought customer bases that expected this type of ongoing relationship, helping the entire company develop subscription-friendly operational habits and customer service capabilities.

Mobile Failure Required Alternative Approaches

Microsoft’s attempt to compete in smartphones ended in expensive failure. The company wrote off $7.6 billion from its Nokia acquisition and eventually abandoned Windows Phone entirely. Rather than continuing to fight battles it couldn’t win, Microsoft adopted a smarter strategy: succeed on other companies’ platforms while building services that transcend any single device.

This strategic pivot influenced subsequent acquisitions. Instead of buying hardware companies or mobile-specific technologies, Microsoft purchased services that work equally well on iOS, Android, and Windows. LinkedIn, GitHub, and gaming services all function regardless of what device someone uses. This platform-agnostic approach let Microsoft succeed in mobile without needing to control the underlying operating system.

The mobile failure taught valuable lessons about picking battles carefully. Not every market requires direct competition. Sometimes the smarter move involves finding ways to profit from trends you can’t control. By making Microsoft services indispensable regardless of what device people use, the company turned a major weakness into irrelevance. Users don’t care about Windows Phone anymore because they can access everything Microsoft offers through the devices they already prefer.

Competing with Tech Giants Required Scale

The technology industry increasingly concentrates power among a small number of massive companies. Amazon, Apple, Google, and Meta each command market valuations exceeding $1 trillion. Competing against these giants requires similar scale, resources, and market presence. Smaller companies get squeezed out or acquired by larger players who can outspend them in research, talent acquisition, and market expansion.

Microsoft’s aggressive acquisition strategy partly reflected this competitive reality. Buying established companies with significant user bases prevented competitors from acquiring them instead. If Google or Amazon had purchased GitHub or LinkedIn, those platforms might have integrated with competing cloud services, making Azure less attractive. Defensive acquisitions protect market position even when they don’t immediately generate returns.

The scale also enables investments that smaller companies can’t match. Microsoft spends over $20 billion annually on research and development. This massive investment budget funds AI research, cloud infrastructure expansion, and experimental technologies that might not pay off for years. Acquisitions accelerate this process by bringing in technologies that are already partially developed, reducing the time and risk involved in bringing new capabilities to market.

Cultural Integration Matters More Than Technology

Acquiring companies is relatively straightforward compared to successfully integrating them afterward. Corporate cultures clash, employees leave, and promised synergies often fail to materialize. Microsoft’s early acquisition history included notable failures where purchased companies never delivered expected value because integration went poorly.

The approach evolved considerably over time. Rather than forcing acquired companies to adopt Microsoft’s culture and processes immediately, the company learned to let successful acquisitions maintain considerable independence. LinkedIn still operates largely autonomously. GitHub maintains its own brand and community relationships. This patience preserved what made these companies valuable in the first place.

Successful integration requires balancing autonomy with coordination. Acquired companies need freedom to maintain their culture and continue innovating, but they also need to integrate with Microsoft’s broader product ecosystem. Finding this balance takes time and careful management. The $140 billion in acquisitions only generates returns if the acquired companies continue thriving after purchase, making cultural integration arguably more important than the initial deal terms.

FAQs

Activision Blizzard for $68.7 billion in 2022, making it the biggest gaming acquisition in history and Microsoft’s most expensive purchase by far.

Yes, most have proven profitable. LinkedIn’s revenue tripled since purchase, and GitHub dramatically expanded its user base while strengthening Microsoft’s developer relationships.

To power Game Pass subscriptions with exclusive content and pivot gaming from hardware-dependent console sales to cloud-based streaming services accessible on any device.

Each acquisition brings services requiring cloud infrastructure. More LinkedIn users, GitHub projects, and Game Pass subscribers all increase demand for Azure computing power.

Likely yes. The company maintains massive cash reserves and views strategic acquisitions as the fastest path to competing in emerging technology markets.