Pin

Pin BlackRock / Photo courtesy Business Fortune

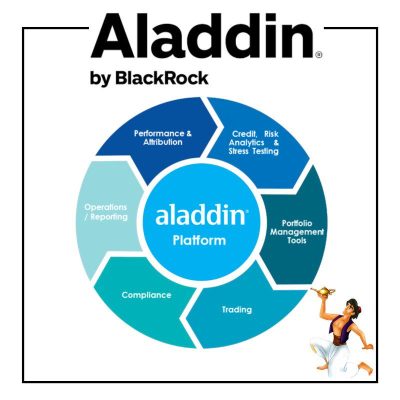

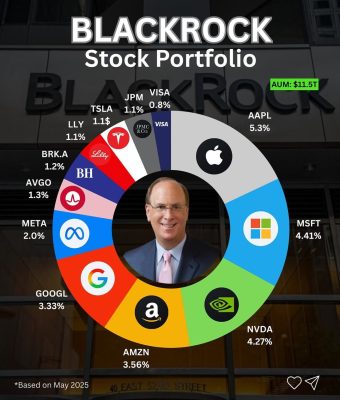

Synopsis: BlackRock manages over $10 trillion in assets, making it the world’s largest investment firm. The secret behind this financial empire isn’t just smart investing—it’s a powerful technology platform called Aladdin. This system combines artificial intelligence, massive data processing, and risk analytics to manage investments across global markets. The platform doesn’t just track money—it predicts risks, automates decisions, and gives thousands of investment professionals the tools to make smarter choices. Understanding how this engine works reveals the future of finance itself.

Wall Street has always been a place where fortunes change hands faster than a riverboat gambler can shuffle cards. But BlackRock Built a Trillion-Dollar Fund Management Engine that changed the rules of the game entirely. The firm didn’t win by being louder or flashier than everyone else—it won by being smarter, in a way that most folks didn’t even notice until it was too late to catch up.

Back in 1988, when BlackRock started out, investment firms still operated much like they had for decades. Traders shouted across floors, analysts buried themselves in paper reports, and risk management meant having a good gut feeling about things. The whole business ran on instinct and experience, which worked well enough until it didn’t. Then came the disasters—the savings and loan crisis, the bond market meltdowns—and suddenly everyone realized that gut feelings weren’t enough when billions of dollars hung in the balance.

BlackRock’s founders saw something that others missed. They understood that information was about to become more valuable than intuition, and that the firm who could process the most data the fastest would eventually run the table. So they built Aladdin, a system that would grow from a simple risk calculator into the most powerful financial technology platform on earth. This is the story of how one company turned computers into the world’s best investment advisors.

Table of Contents

The Birth of Aladdin - When Risk Management Got Smart

Pin

Pin Photo courtesy Reddit user r/Superstonk

The story starts with a painful lesson. In the 1980s, bond traders at various firms lost enormous sums because they couldn’t properly measure what would happen if interest rates suddenly jumped or dropped. They had the data sitting right there in filing cabinets and computer systems, but no good way to run the calculations fast enough to matter. By the time anyone figured out how exposed they were to risk, the damage was already done.

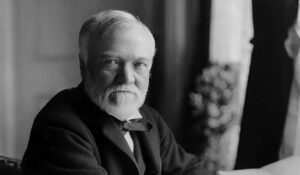

Larry Fink, who would go on to found BlackRock, experienced one of these disasters firsthand while working at First Boston. He watched a hundred million dollars evaporate because nobody had properly modeled the risks hidden inside complex mortgage securities. That loss taught him something important: the financial industry desperately needed better tools to understand what might go wrong before it actually did. The old way of doing things—relying on experience and simple calculations—couldn’t keep up with how complicated investments had become.

So when Fink and his partners started BlackRock, they made a radical decision. They would build their own risk management system and make it the foundation of everything they did. They called it Aladdin, which stood for Asset, Liability, Debt and Derivative Investment Network. The name made it sound like something that could grant wishes, and in a way, it did—it gave investors the ability to see the future, or at least the many possible futures their money might face.

Building a System That Could See Around Corners

Pin

Pin BlackRock Stock Portofolio / Photo courtesy Jeffry Budiman

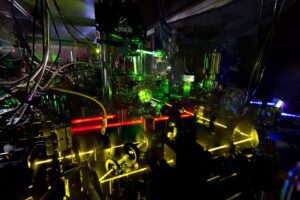

The early version of Aladdin wasn’t particularly fancy by today’s standards. It was essentially a very powerful calculator that could run thousands of scenarios on bonds and other fixed-income securities. The system would ask a simple but crucial question over and over again: what happens to this investment if things change? What if interest rates go up by one percent? Two percent? What if they drop? What if the economy tanks or takes off?

Most investment firms at the time could run maybe a handful of these scenarios, and it might take hours or even days to get results. Aladdin could run thousands of scenarios in minutes. This meant that portfolio managers could actually test their assumptions before putting real money at risk. They could see which investments were solid no matter what happened, and which ones were basically bets that everything would stay calm and predictable.

The real genius wasn’t just in the calculations themselves, though. BlackRock built Aladdin to store every single piece of data it touched. Every trade, every price change, every scenario it ran—all of it went into a massive database that kept growing smarter over time. The system started learning patterns that human analysts would never spot on their own, simply because humans can’t hold thousands of variables in their heads at once. Aladdin could, and it remembered everything.

The Data Advantage - Turning Information into Gold

Here’s something most people don’t realize about modern investing: the hard part isn’t finding information. Markets generate data constantly, like a fire hydrant spraying numbers all day long. Stock prices, bond yields, currency rates, economic reports, corporate earnings—it all pours out in real time. The hard part is making sense of it all before everyone else does, and then actually using that understanding to make better decisions.

BlackRock realized early on that whoever could collect, organize, and analyze the most data would have an enormous advantage. So Aladdin became a vacuum cleaner for financial information. The system pulled in market data, yes, but also weather patterns that might affect agricultural commodities, shipping routes that could impact oil prices, and economic indicators that most people had never even heard of. Every piece of information was another pixel in a picture that kept getting clearer.

What made this especially powerful was that BlackRock wasn’t just using this data for their own investments. As Aladdin grew more sophisticated, other investment firms started paying BlackRock to use the platform too. This created a beautiful feedback loop: more clients meant more data flowing into Aladdin, which made the system smarter, which attracted even more clients. By the 2000s, Aladdin was processing information about trillions of dollars in assets, giving it a view of the global financial system that nobody else could match.

When Artificial Intelligence Joined the Party

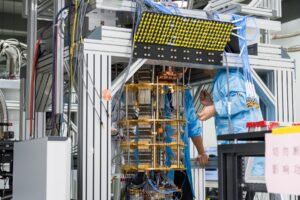

For years, Aladdin operated mostly on rules that humans had programmed into it. If this happens, then do that. If these conditions are met, flag this as risky. The system was smart, but it was smart in a mechanical way, following instructions rather than actually learning. Then artificial intelligence and machine learning started maturing, and BlackRock saw another opportunity to leap ahead of everyone else.

The firm started teaching Aladdin to recognize patterns on its own, without humans having to spell out every single rule. The system could now look at decades of market data and figure out which signals actually mattered and which were just noise. It could spot the subtle warning signs that appeared before market crashes, the tiny correlations between seemingly unrelated assets, the ways that risk liked to hide in complicated investments.

This is harder to do than it sounds, and it’s worth understanding why. Markets aren’t like physics problems where the same conditions always produce the same results. They’re messy and emotional and full of feedback loops where people’s expectations about the future actually change the future. But with enough data and the right algorithms, Aladdin started getting good at predicting not just what might happen, but what would probably happen given everything it knew about how markets had behaved in the past.

The Risk Management Revolution

Most people think about investing in terms of returns—how much money did you make? But professional investors know that the real question is: how much risk did you take to make that money? Anyone can get high returns by betting everything on risky investments. The trick is getting good returns while keeping risks under control, and that’s exactly what Aladdin was built to do.

The system approaches risk like a doctor doing a full-body scan. It doesn’t just look at individual investments in isolation; it examines how everything in a portfolio works together. Two investments might each look reasonably safe on their own, but if they both crash under the same conditions, holding them together is much riskier than it appears. Aladdin can spot these hidden connections, the ways that risks cluster and amplify each other when things go wrong.

This capability proved its worth during the 2008 financial crisis. While many investment firms were blindsided by how bad things got, BlackRock’s clients who used Aladdin had much better visibility into their exposure. They could see the crisis building in their portfolios before it fully hit, giving them time to adjust. Some still lost money—everyone did in 2008—but they lost less than they would have otherwise. That’s when the rest of the financial world started taking Aladdin very seriously indeed.

Building the Operating System for Global Finance

Think about how Microsoft Windows or Apple’s iOS became the foundation that millions of applications run on. That’s essentially what Aladdin has become for the investment world—an operating system that handles all the basic infrastructure so that investment professionals can focus on strategy and decision-making rather than wrestling with data and calculations.

The platform handles an astonishing range of tasks. It processes trades, tracks portfolios, manages risk, handles compliance and regulatory reporting, and even helps with client communications. An investment firm using Aladdin doesn’t need to build or maintain dozens of separate systems that somehow need to talk to each other. Everything runs through one integrated platform that already knows how all the pieces fit together.

This integration creates efficiency that smaller firms simply can’t match on their own. A portfolio manager can test an investment idea, check it against risk limits, place the trade, and document everything for regulators—all within the same system, in minutes rather than hours or days. The system handles the tedious parts automatically, freeing up humans to do what humans do best: think creatively, build relationships, and make judgment calls in ambiguous situations.

The Network Effect - How Size Became Its Own Advantage

Here’s where BlackRock’s strategy gets really interesting. By licensing Aladdin to other investment firms, pension funds, insurance companies, and even central banks, they created something bigger than just a product. They built a network where everyone’s data and everyone’s usage makes the system better for everyone else.

When Aladdin processes a trade or analyzes a security, it’s drawing on insights from thousands of other users who’ve looked at similar situations. The system knows how different types of investors typically react to certain market conditions because it sees those reactions happening in real time across its entire user base. This collective intelligence makes Aladdin smarter than any single firm could make their own proprietary system, no matter how much money they spent on development.

The network also creates what economists call “switching costs.” Once a firm has integrated Aladdin into their operations, trained their staff on it, and built their workflows around it, moving to a different platform becomes incredibly difficult and expensive. The firm would have to migrate years of data, retrain everyone, and rebuild all their custom reports and processes. Most firms decide it’s not worth the hassle, especially when Aladdin keeps getting better anyway.

The Human Element - Why Smart Tools Still Need Smart People

For all its power, Aladdin doesn’t actually make investment decisions. That’s a crucial point that often gets lost in discussions about AI in finance. The system provides information, runs scenarios, flags risks, and offers recommendations, but humans still make the final calls. This isn’t a limitation—it’s by design, and it’s probably the smartest decision BlackRock ever made about the platform.

Markets aren’t purely mathematical systems. They’re shaped by human psychology, political decisions, technological changes, and random events that no algorithm can fully predict. Aladdin might calculate that a certain investment has a seventy percent chance of success based on historical patterns, but it can’t account for the fact that a charismatic CEO just joined the company, or that a new regulation is about to reshape the industry, or that consumer tastes are shifting in ways that haven’t shown up in the data yet.

The real magic happens when experienced investment professionals use Aladdin as a thinking partner rather than a replacement for thinking. They use the system to test their ideas, challenge their assumptions, and spot risks they might have missed. The computer handles the number-crunching and pattern-recognition at superhuman speed, while the humans bring context, creativity, and judgment. Neither works as well alone as they do together.

Regulatory Oversight and the Too-Big-to-Fail Question

BlackRock’s size and influence have made some people nervous, and not without reason. When one company’s technology platform processes information about a substantial portion of global financial assets, that platform becomes critical infrastructure. If Aladdin went down for an extended period, or if it made systematic errors that affected thousands of portfolios simultaneously, the ripple effects could be enormous.

Regulators have started paying closer attention to what they call “concentration risk” in financial technology. They worry about scenarios where many different investment firms, all using the same platform, might react to market stress in similar ways because they’re all getting similar signals from the same system. In a crisis, this could amplify market swings rather than dampen them, as everyone tries to reduce risk at the same time.

BlackRock has responded by building redundancy into Aladdin’s infrastructure and cooperating with regulators to ensure the system meets strict operational standards. The firm also points out that Aladdin doesn’t make decisions—it provides information that different firms use in different ways. Two portfolio managers looking at the same Aladdin reports might reach completely different conclusions based on their strategy, time horizon, and risk tolerance. Still, the debate about whether any single platform should be this central to global finance continues.

The Money Behind the Machine - How Technology Became BlackRock's Real Product

Here’s something that might surprise you: BlackRock makes more money from Aladdin than many successful software companies make from their products. The firm charges clients based on the assets they manage through the platform, which means revenue scales up automatically as clients grow or as new clients come aboard. It’s a beautiful business model.

But the real value goes beyond the direct fees. Having so many firms rely on Aladdin gives BlackRock relationships and insights that money can’t buy. When pension funds and sovereign wealth managers need advice on building their investment operations, they often turn to the company that knows their systems inside and out. When market crises hit and everyone needs better risk management, there’s already a proven solution available.

The platform also helps BlackRock win mandates to manage money directly. When a pension fund is choosing between investment managers, the one who already uses the same technology platform they do has a natural advantage. The integration is easier, reporting is simpler, and there’s less risk of miscommunication. This creates a flywheel effect where Aladdin wins BlackRock technology clients, which helps BlackRock win asset management clients, which generates more data that makes Aladdin better, which attracts more technology clients.

The Future - Where AI and Investment Management Go Next

The next frontier for platforms like Aladdin involves making artificial intelligence even more proactive and predictive. Current systems are excellent at analyzing what’s happening right now and what happened in the past, but the real prize is getting better at anticipating what comes next. This means incorporating more diverse data sources—satellite imagery showing retail parking lots, credit card transaction patterns, social media sentiment, even weather and climate models.

Machine learning algorithms are also getting better at explaining their reasoning, which is crucial for investment management. A system that just spits out a recommendation without showing its work isn’t that useful, because portfolio managers need to understand why the AI thinks what it thinks. The latest approaches to AI can now highlight which factors mattered most in a recommendation, making the technology more transparent and trustworthy.

Climate risk represents another major evolution for platforms like Aladdin. Investors increasingly want to understand how their portfolios might be affected by climate change, new environmental regulations, and the transition to renewable energy. This requires modeling scenarios that have never happened before, which is harder than analyzing historical patterns. But as companies report more climate data and as the science improves, AI systems are getting better at incorporating these long-term risks into their analysis. The firms that crack this problem first will have the same kind of advantage BlackRock had when it pioneered modern risk management decades ago.

FAQs

Aladdin is BlackRock’s investment management platform that combines data analytics, risk modeling, and AI to help manage trillions in assets. It processes market data, runs scenarios, and flags risks automatically.

Aladdin is designed for institutional investors like pension funds and investment firms, not individual retail investors. However, your retirement fund likely uses it behind the scenes.

Aladdin processes information about over $20 trillion in assets globally, though BlackRock itself directly manages around $10 trillion as an investment firm.

No. Aladdin provides analysis and recommendations, but human portfolio managers make the final investment decisions. The AI assists rather than replaces human judgment.

BlackRock has built extensive safeguards and redundancies. However, regulators do monitor concentration risk since so many firms rely on the platform for critical operations.