Pin

Pin Rare Earth Metals / Courtesy of Chemical Elements

Synopsis: Rare earth metals power trillion-dollar industries, from smartphones to defense systems, yet their production remains concentrated in surprisingly few hands. The global supply chain for these seventeen critical elements creates dependencies that governments and corporations are scrambling to address. While rare earth deposits exist across multiple continents, the infrastructure to extract and refine them tells a different story. Understanding which countries produce, process, and stockpile these metals reveals the hidden architecture behind modern technology and emerging supply chain vulnerabilities.

Your iPhone contains at least sixteen different rare earth elements. So does nearly every electric vehicle, wind turbine, and precision-guided missile manufactured today. These metals with forgettable names like lanthanum and praseodymium have become the quiet backbone of the digital economy, and most consumers have never heard of them.

The global rare earth industry generates billions in revenue annually, yet production concentrates in just a handful of countries. This isn’t because deposits are scarce. Geologists have identified commercially viable rare earth reserves on every continent except Antarctica. The real constraint is processing capacity, which requires substantial capital investment, technical expertise, and a willingness to manage significant environmental challenges that come with extraction and refining.

The concentration of rare earth production has created what industry analysts call a critical supply chain vulnerability. When one country controls the majority of global output, downstream industries from automotive to aerospace face potential disruption. That’s why governments from Washington to Brussels are now pouring resources into domestic production capabilities, trying to reshape a market that took decades to develop its current structure. Here’s how the global rare earth landscape actually breaks down and why it matters for tech companies, manufacturers, and national security planners alike.

Table of Contents

1. China's Overwhelming Market Dominance

China produces approximately 60% of the world’s rare earth metals and controls roughly 85% of global processing capacity. This dominance didn’t happen overnight. Beijing spent decades building the infrastructure, refining techniques, and accepting environmental costs that other nations avoided. The result is an integrated supply chain that runs from mine to finished magnet, all within Chinese borders.

The scale of China’s operations dwarfs all competitors combined. Inner Mongolia’s Bayan Obo mine alone contains more rare earth reserves than most countries possess in total. Chinese companies have also invested heavily in overseas deposits, particularly across Africa and Southeast Asia, extending their influence beyond domestic production.

This market position gives Beijing considerable leverage in trade negotiations and geopolitical disputes. In 2010, China briefly restricted rare earth exports to Japan during a territorial dispute, sending shockwaves through global manufacturing. That incident prompted other nations to finally recognize their dependency and start developing alternatives, though progress has been slower than many hoped.

2. The United States Plays Catch-Up

The US once led global rare earth production. California’s Mountain Pass mine supplied most of the world’s rare earths through the 1990s before Chinese competition drove prices down and made American operations unprofitable. The mine closed in 2002, and for years the Pentagon had to buy critical materials from Chinese suppliers.

Mountain Pass reopened in 2018 under new ownership, but the US still lacks processing infrastructure. American miners extract ore, then ship it to China for refining before it returns as finished materials. This round-trip dependency undermines the goal of supply chain independence and adds costs that make US production less competitive.

Washington has committed billions in funding to rebuild domestic processing capacity. The Department of Defense has partnered with private companies to establish separation facilities in Texas and elsewhere. However, building this infrastructure takes time, and the US remains years away from true self-sufficiency in rare earth processing and manufacturing.

3. Australia's Growing Production Footprint

Australia ranks second globally in rare earth mining, contributing roughly 15% of world production. The country’s Lynas Corporation operates one of the few large-scale rare earth mines outside China, located at Mount Weld in Western Australia. Lynas also built a processing plant in Malaysia, though it has faced local opposition over environmental concerns.

Australian deposits contain particularly high concentrations of neodymium and praseodymium, two elements essential for permanent magnets used in electric vehicles and wind turbines. This makes Australian production strategically valuable as clean energy adoption accelerates. The government has designated rare earths as critical minerals and provides financial support for development projects.

Australia’s geographic position and political stability make it an attractive alternative supplier for countries seeking to reduce Chinese dependency. Several joint ventures between Australian miners and international partners are in development, including processing facilities that would keep the entire supply chain within allied nations. The main challenge remains competing with China’s established cost advantages and economies of scale.

4. Myanmar's Controversial Supply Lines

Myanmar supplies a significant portion of global heavy rare earth elements, particularly dysprosium and terbium, which are crucial for high-performance magnets and defense applications. Most Myanmese production crosses the border into China, where it gets processed and enters global supply chains. This unofficial trade has exploded over the past decade, with some estimates suggesting Myanmar now contributes 25% of China’s rare earth feedstock.

The problem is that much of this mining happens illegally or in areas controlled by armed groups. Environmental standards are essentially non-existent, and the profits often fund ongoing conflicts in Myanmar’s northern regions. Western companies face ethical dilemmas when their supply chains trace back to these operations, even indirectly through Chinese processors.

International buyers have limited visibility into the true origins of rare earths that pass through China. This opacity makes it nearly impossible to guarantee conflict-free sourcing. Some companies are developing blockchain tracking systems and demanding greater transparency, but enforcement remains difficult when materials get mixed during processing.

5. Vietnam's Emerging Position

Vietnam holds substantial rare earth reserves, particularly in the northern provinces near the Chinese border. The country has been quietly developing its mining sector with an eye toward becoming a major supplier. Vietnamese deposits are rich in medium and heavy rare earths, which are more valuable and less common than the light rare earths that dominate many other deposits.

The Vietnamese government has moved cautiously, aware of the environmental damage that rapid development can cause. Several state-owned enterprises have partnered with international firms to develop extraction and processing capabilities. Japan has been particularly active in supporting Vietnamese rare earth development as part of its own supply chain diversification strategy.

Vietnam’s political relationship with China adds complexity to its rare earth ambitions. While the countries compete economically, they share a border and extensive trade ties. How Vietnam balances domestic development with regional politics will shape its role in the global rare earth market over the coming decade.

6. Russia's Untapped Potential

Russia possesses some of the world’s largest rare earth reserves but produces relatively small quantities. The Tomtor deposit in Siberia alone could supply global demand for decades, yet it remains largely undeveloped due to harsh climate, remote location, and lack of infrastructure. Russian production currently meets only domestic needs, with minimal exports.

Geopolitical tensions have complicated Russia’s rare earth prospects. Western sanctions limit access to technology and investment needed for large-scale development. Meanwhile, Russia has strengthened ties with China, which provides both a market for future production and technical assistance for developing processing capabilities.

Climate change may ironically benefit Russian rare earth development by making Arctic deposits more accessible. However, the capital requirements and technical challenges remain substantial. Unless international relations shift or domestic priorities change, Russia’s rare earth wealth will likely stay underground for years to come.

7. Brazil's Hidden Deposits

Brazil ranks among the top countries in rare earth reserves but punches well below its weight in actual production. The country’s deposits are scattered across several states, with significant concentrations in Minas Gerais. Environmental regulations and bureaucratic hurdles have slowed development, though several projects are now moving forward after years of delays.

Brazilian rare earths are particularly rich in heavy elements, which command premium prices. The country’s mining giants have the technical expertise and financial resources to develop world-class operations. What’s been missing is political will and consistent regulatory frameworks that give investors confidence in long-term projects.

Recent government initiatives suggest this may be changing. Brazil has designated rare earths as strategic minerals and streamlined permitting for certain projects. If these efforts succeed, Brazil could become a major supplier within the next decade, particularly for Western Hemisphere customers seeking to reduce shipping distances and geopolitical risks.

8. India's Self-Sufficiency Push

India possesses substantial rare earth reserves along its southern coast, particularly in beach sands that contain monazite, a mineral rich in rare earth elements. The country has been mining these deposits for decades but primarily for thorium extraction rather than rare earths. Now India is pivoting to develop a complete domestic supply chain.

The Indian government has made rare earth self-sufficiency a national priority, driven by both economic and security concerns. State-owned enterprises are building separation facilities and developing processing techniques. India’s large manufacturing sector provides built-in demand for rare earth products, creating economies of scale that could make domestic production viable.

India faces technical challenges in processing rare earths efficiently at commercial scale. The country’s scientific establishment has expertise in nuclear materials but less experience with rare earth metallurgy. International partnerships with Japan, Australia, and the United States are helping bridge this knowledge gap while aligning with India’s broader geopolitical positioning.

9. Canada's Cautious Development

Canada has significant rare earth deposits across several provinces, with particularly promising sites in Quebec, Saskatchewan, and the Northwest Territories. The country’s strong mining sector and strict environmental standards make it an attractive location for development. Several projects are in various stages of planning and construction, though none yet operate at scales comparable to major Asian producers.

Canadian developers face challenges competing with Chinese prices while meeting domestic environmental regulations. The cost of Canadian labor, energy, and compliance adds substantially to production expenses. Government support through grants and loan guarantees has helped some projects move forward, but commercial viability remains uncertain without sustained high prices or long-term purchase agreements.

The US and European buyers view Canadian sources as politically stable alternatives worth paying premiums for. This has attracted investment from downstream users who want supply chain security more than they want the lowest possible price. If these projects succeed, Canada could supply 10-15% of Western rare earth demand within five years.

10. Greenland's Controversial Reserves

Greenland holds vast rare earth deposits, particularly at Kvanefjeld in the south. This single site contains enough rare earths to supply global demand for decades, along with significant uranium deposits. However, development has become politically toxic in Greenland, where residents worry about environmental impacts on fishing waters and the territory’s pristine landscape.

In 2021, Greenland elected a government that campaigned specifically against the Kvanefjeld mine, effectively halting the project despite years of planning and hundreds of millions in investment. This decision reflected local priorities but disappointed international partners hoping for new supply sources. The political shift demonstrates how even countries with massive reserves may choose not to develop them.

Greenland’s rare earth story illustrates the broader tension between resource development and environmental protection. While other nations might welcome the economic benefits of major mining projects, Greenland’s small population and unique ecosystem create different calculations. The deposits will remain in the ground until political consensus shifts or technology advances enough to address environmental concerns.

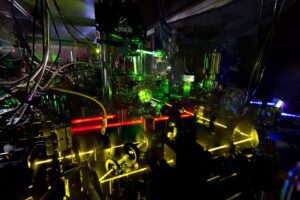

11. The Processing Bottleneck That Changes Everything

Mining rare earth ore is actually the easy part. The real challenge is separating seventeen chemically similar elements from each other and refining them into usable forms. This processing requires sophisticated facilities, experienced technicians, and handling of toxic chemicals. China’s dominance in processing is even more pronounced than in mining, creating a chokepoint that no amount of new mines can fix quickly.

Building a processing facility takes five to seven years and hundreds of millions of dollars. The technology is well understood but operationally complex, with small variations in ore composition requiring different approaches. Even countries that successfully develop mines often lack the downstream infrastructure, forcing them to ship ore to China for processing.

This explains why the global rare earth supply chain remains concentrated despite decades of concerns and numerous initiatives to diversify. New mines in Australia, Africa, and North America still depend on Chinese processing. Until the West builds its own separation and refining capacity at scale, the dependency will continue regardless of where the ore comes from. That’s the bottleneck that governments and companies are now racing to address, though success remains years away.

FAQs

The processing is expensive, environmentally messy, and requires expertise that takes decades to develop. Most countries find it cheaper to just buy from China.

Not really. They’re relatively common in Earth’s crust, but they’re dispersed and mixed together, making extraction and separation difficult and costly.

Yes, but it’s currently more expensive than mining new material. As prices rise and technology improves, recycling will become more economically viable.

Terbium and dysprosium command the highest prices because they’re scarcer and essential for high-performance magnets that can’t easily use substitutes.

It’s possible but unlikely. China benefits economically from exports, and restricting them would accelerate other countries’ efforts to develop alternatives.