Pin

Pin Image by Marketing Mentor

You walk into a mall, grab coffee at different shops, drive various car brands, and use multiple apps—thinking you’re supporting diverse businesses. But here’s the plot twist that’ll make your next shopping trip feel like a corporate treasure hunt: many of these seemingly independent brands are actually siblings under the same corporate roof.

The business world is full of these surprising family trees. That luxury sports car and the budget-friendly sedan in your neighborhood might share the same boardroom. Your morning coffee brand and evening snack choice could be making the same executives very happy. It’s like discovering your favorite rival bands are actually managed by the same record label—except with billions of dollars involved.

Ready to peek behind the curtain? Let’s explore how a handful of corporate giants have quietly assembled empires that touch nearly every aspect of your daily life, often in ways that would genuinely surprise you.

Table of Contents

The Food Empire That Feeds Your Cravings

Pin

Pin Image by Marketing Mentor

When you’re standing in the food court debating between Pizza Hut, KFC, or Taco Bell, you’re actually choosing between three children of the same corporate family. Yum! Brands quietly runs this fast-food empire, operating over 55,000 restaurants across 155 countries. Each brand feels completely different—Pizza Hut’s casual family vibe, KFC’s Southern comfort, Taco Bell’s quirky late-night energy—yet they all report to the same boardroom.

The genius lies in how seamlessly they operate as separate entities while sharing resources underneath. Your neighborhood Pizza Hut and KFC likely use the same suppliers, training systems, and operational strategies developed by their parent company. This shared infrastructure helps explain how Yum! Brands generates over $6 billion annually while each restaurant chain maintains its distinct brand identity. It’s corporate efficiency disguised as friendly competition.

The Automotive Giants Playing Musical Chairs

Pin

Pin Image by Marketing Mentor

The luxury car market looks like a playground where German engineering reigns supreme, but the ownership web runs deeper than most drivers realize. BMW Group doesn’t just make the iconic sedans and SUVs bearing its name—they also own Rolls-Royce, the epitome of British luxury, and Mini, the cheeky compact car that feels like BMW’s rebellious younger sibling. This trio covers everything from affordable city driving to vehicles that cost more than most people’s houses.

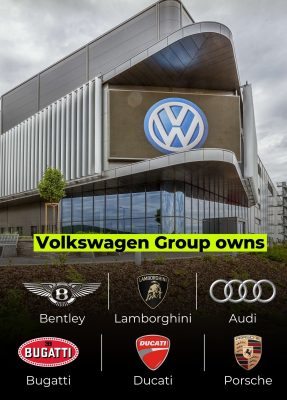

Meanwhile, Volkswagen Group has quietly assembled one of the most diverse automotive empires on the planet. They control Audi’s sleek sophistication, Porsche’s racing heritage, Lamborghini’s Italian fire, Bentley’s British refinement, Bugatti’s record-breaking speed machines, and Ducati’s motorcycle mastery. When you see these brands competing at auto shows or on racetracks, they’re essentially family members putting on a good show. It’s brilliant business strategy—cover every price point and personality type while sharing technology, research, and manufacturing expertise across the entire portfolio.

The Social Media Empire Living in Your Pocket

Pin

Pin Image by Marketing Mentor

Your daily digital routine probably involves jumping between Instagram, Facebook, and WhatsApp, but you’re never actually leaving Meta’s ecosystem. Mark Zuckerberg’s company owns all three platforms, creating a social media monopoly that reaches nearly 4 billion people worldwide. Each app serves a different purpose—Instagram for visual storytelling, Facebook for community connections, WhatsApp for private messaging—yet they all feed data and insights back to the same corporate brain.

This ownership structure explains why your Instagram ads sometimes eerily reflect your Facebook activity, or why WhatsApp’s business features integrate so smoothly with Facebook’s advertising tools. Meta has essentially created a social media sandwich where users can’t escape their influence, no matter which app they prefer. The company generates over $130 billion annually by keeping people within their digital universe, making it nearly impossible to use social media without contributing to Meta’s bottom line. It’s a masterclass in ecosystem building disguised as user choice.

The Beverage Empire Quenching Global Thirst

Pin

Pin Image by Marketing Mentor

The Coca-Cola Company has turned beverage domination into an art form that extends far beyond their signature red cans. While everyone recognizes the classic Coke logo, fewer people realize they also control Sprite’s citrus refreshment, Fanta’s fruity flavors, and Minute Maid’s juice empire. This beverage giant operates in over 200 countries, selling nearly 2 billion servings daily across their massive portfolio.

The strategy behind this ownership is beautifully simple—control every beverage mood and moment. Craving something bubbly? They’ve got multiple cola options. Want something citrusy? Sprite’s waiting. Need vitamin C? Minute Maid has you covered. Coca-Cola has essentially built a liquid empire where switching brands often means staying within the same corporate family. Their annual revenue of $43 billion proves that owning the entire beverage experience, rather than just one flavor profile, creates an unstoppable market presence that keeps competitors scrambling for shelf space.

The Tech Giant That Powers Your Daily Searches

Pin

Pin Image by Marketing Mentor

Alphabet, Google’s parent company, has woven itself into your daily routine in ways that go far beyond search results. While Google handles your questions, YouTube entertains your evenings, Fitbit tracks your steps, and Waymo might eventually drive your car. This tech conglomerate has strategically positioned itself at nearly every digital touchpoint, generating over $280 billion annually by owning the tools you use to work, play, and stay healthy.

The brilliant part about Alphabet’s approach is how naturally their services connect without feeling forced. Your Google account seamlessly syncs with YouTube recommendations, which might inspire fitness goals tracked on your Fitbit, while Waymo’s self-driving technology learns from Google Maps data. Each subsidiary feels independent, yet they all feed valuable user insights back to the mothership. This ecosystem approach has made Alphabet one of the world’s most valuable companies by ensuring that switching away from Google means abandoning an entire digital lifestyle that billions of people now consider essential.

The Luxury Empire That Defines Elegance

Pin

Pin Image by Marketing Mentor

LVMH has quietly built the most prestigious luxury empire on Earth, controlling brands that define sophistication across multiple industries. Louis Vuitton’s iconic handbags, Dior’s haute couture, Fendi’s Italian craftsmanship, Céline’s minimalist chic, Givenchy’s Parisian elegance, Bulgari’s sparkling jewelry, and Moët & Chandon’s celebratory champagne all belong to the same French conglomerate. When celebrities walk red carpets dripping in luxury, they’re often wearing head-to-toe LVMH without realizing it.

This luxury monopoly generates over $86 billion annually by owning every aspect of the premium lifestyle experience. Whether you’re shopping for a wedding ring, planning a celebration, or investing in a statement piece, LVMH likely has a brand positioned perfectly for your budget and taste level. Their strategy transforms luxury shopping from brand competition into brand collaboration—different facets of the same diamond, each catching light from a different angle while contributing to the same glittering empire that has made Bernard Arnault one of the world’s wealthiest individuals.

The Hospitality Empire That Shelters Your Travels

Pin

Pin Image by Marketing Mentor

Marriott International has transformed the hotel industry by collecting accommodation brands like precious stamps, creating a portfolio that covers every travel budget and style. Whether you’re booking a business trip at a Sheraton, splurging on a Ritz-Carlton weekend, enjoying a Westin spa retreat, or choosing the boutique charm of Le Méridien, you’re actually staying within the same hotel family. Their empire spans over 8,000 properties across 139 countries, making it nearly impossible to travel without encountering their hospitality network.

The masterstroke behind Marriott’s strategy lies in how they’ve segmented the market without cannibalizing their own brands. Each hotel chain targets different travelers—Ritz-Carlton courts luxury seekers, Sheraton appeals to business professionals, Westin attracts wellness-focused guests, and Le Méridien draws design enthusiasts. This approach generates over $20 billion annually by ensuring that no matter your travel style or budget, Marriott has a perfectly positioned option waiting. It’s like having a hotel for every personality, all managed by the same hospitality experts who understand that great travel experiences transcend brand names.

The Media Empire That Shapes Your Entertainment

Pin

Pin Image by Marketing Mentor

Disney has evolved from a cartoon mouse into an entertainment octopus with tentacles reaching into every corner of popular culture. Beyond their classic animated films, Disney owns Marvel’s superhero universe, Lucasfilm’s Star Wars galaxy, Pixar’s heartwarming stories, ESPN’s sports coverage, ABC’s television programming, and the streaming platform that binds them all together—Disney+. This media empire generates over $82 billion annually by controlling characters, stories, and distribution channels that define modern entertainment.

The genius behind Disney’s acquisition strategy becomes clear when you realize how seamlessly their properties cross-pollinate. Marvel characters appear in Disney theme parks, Star Wars stories get Pixar-quality animation treatment, ESPN covers Disney-owned sports teams, and ABC promotes Disney movies during prime time. Each subsidiary maintains its creative identity while contributing to a unified entertainment ecosystem. When Disney releases a major film, they’re not just selling movie tickets—they’re launching merchandise lines, theme park attractions, streaming content, and television specials all within their own corporate family, maximizing revenue from every story they tell.

The Beauty Empire That Defines Your Look

Pin

Pin Image from official site

L’Oréal Group has quietly assembled a beauty empire that spans from drugstore shelves to luxury counters, controlling brands that define how millions of people approach personal care. Their portfolio includes Maybelline’s accessible glamour, Urban Decay’s edgy cosmetics, Lancôme’s sophisticated skincare, Kiehl’s natural beauty philosophy, Garnier’s affordable hair care, and Yves Saint Laurent’s luxury makeup line. This French beauty giant operates in 150 countries, making it nearly impossible to shop for cosmetics without funding their massive research laboratories.

What makes L’Oréal’s dominance particularly impressive is how they’ve mastered every price point and beauty philosophy without diluting any brand’s identity. A teenager buying Maybelline mascara and a luxury shopper investing in Lancôme serums are both contributing to the same corporate research that develops breakthrough ingredients and technologies. This shared innovation engine generates over $38 billion annually while each brand maintains its distinct personality and customer loyalty. L’Oréal has essentially created a beauty democracy where everyone can access their research, just through different brand doorways.

The Automotive Empire That Rules Every Road

Pin

Pin Image by Marketing Mentor

Volkswagen Group has quietly assembled one of the most impressive automotive empires on the planet, controlling brands that span from everyday transportation to ultimate luxury. Their portfolio includes Audi’s sophisticated engineering, Porsche’s legendary sports cars, Lamborghini’s Italian supercar drama, Bentley’s handcrafted British elegance, Bugatti’s record-breaking hypercars, and Ducati’s motorcycle excellence. When you see these brands competing at auto shows or on racetracks, they’re essentially family members putting on an elaborate performance.

This automotive giant operates across every conceivable market segment while sharing cutting-edge technology, research facilities, and manufacturing expertise throughout their entire portfolio. A breakthrough in electric vehicle technology developed for Audi might eventually power a Lamborghini, while Porsche’s racing innovations could enhance Bentley’s performance capabilities. Volkswagen Group generates over $280 billion annually by ensuring that whether you’re buying your first car or your dream supercar, you’re likely staying within their automotive ecosystem. It’s brilliant business strategy—own every price point and driving personality while leveraging shared resources to outpace competitors who focus on single market segments.

The Consumer Goods Empire That Stocks Your Home

Pin

Pin Image from Official Site

Procter & Gamble has built a household empire so comprehensive that your entire daily routine likely involves their products without you noticing. From brushing your teeth with Crest, washing your hair with Head & Shoulders, cleaning clothes with Tide, buying diapers from Pampers, shaving with Gillette, and cleaning surfaces with Mr. Clean—P&G has strategically positioned itself in nearly every room of your house. This consumer goods giant operates in 180 countries, making their brands as ubiquitous as electricity.

The brilliance of P&G’s approach lies in how they’ve conquered mundane necessities that people buy repeatedly without much thought. These aren’t impulse purchases or luxury splurges—they’re the boring, essential products that keep households functioning. This strategy generates over $80 billion annually because their brands have become so embedded in daily routines that switching feels unnecessarily complicated. P&G has essentially made themselves invisible through visibility, creating brand loyalty so strong that consumers often forget they have choices, making the parent company one of the most stable and profitable enterprises in the world.

FAQs

Brands maintain separate identities because customers connect emotionally with individual brand stories, not corporate structures. Each brand targets different audiences and price points—imagine if Taco Bell suddenly started advertising as “a Yum! Brands experience.” It would dilute the unique personality that makes customers choose it over competitors. This separation allows companies to capture multiple market segments without confusing their positioning.

Yes, extensively. Parent companies often share manufacturing facilities, supply chains, research labs, and distribution networks across their brands. Volkswagen’s luxury and economy cars might use the same safety technologies, while L’Oréal’s drugstore and high-end brands benefit from identical research breakthroughs. This resource sharing helps maintain competitive pricing while each brand keeps its distinct market identity.

Not intentionally—ownership information is publicly available in financial reports. However, many people simply don’t research corporate structures before purchasing. Companies maintain separate brand identities for strategic reasons, not to deceive. Most consumers choose products based on quality and personal preference rather than parent company politics, so the ownership rarely influences actual buying decisions.

It creates both benefits and drawbacks. Large parent companies can fund expensive research and development that smaller companies couldn’t afford, leading to genuine innovations. However, when fewer corporations control more brands, it can reduce authentic competition and limit truly diverse options. The result is often high-quality products within established categories, but potentially fewer revolutionary disruptions.

It’s challenging but possible with research and higher costs. Independent alternatives exist in most industries, though they typically charge premium prices since they lack the economies of scale that make corporate brands affordable. The practical approach is being selective—supporting independent businesses in categories that matter most to you while accepting corporate brands for everyday necessities.